Mr Taxman - Dr Adrian Raftery

The coordinates that you can use in navigation applications to get to find Mr Taxman - Dr Adrian Raftery quickly are -38.259225 ,145.059244

Contact and Address

| Address: | 3 Bannie Ln, Mount Martha VIC 3934, Australia |

|---|---|

| Postal code: | 3934 |

| Phone: | 1800 829 626 |

| Website: | http://www.mrtaxman.com.au/ |

Opening Hours:

| Monday: | 8:00 AM – 6:00 PM |

|---|---|

| Tuesday: | 8:00 AM – 6:00 PM |

| Wednesday: | 8:00 AM – 6:00 PM |

| Thursday: | 8:00 AM – 6:00 PM |

| Friday: | 8:00 AM – 6:00 PM |

| Saturday: | Closed |

| Sunday: | Closed |

Location & routing

Reviews

There are no reviews yet!

You can review this Business and help others by leaving a comment. If you want to share your thoughts about Mr Taxman - Dr Adrian Raftery, use the form below and your opinion, advice or comment will appear in this space.

Photos of Mr Taxman - Dr Adrian Raftery

Mr Taxman - Dr Adrian Raftery On the Web

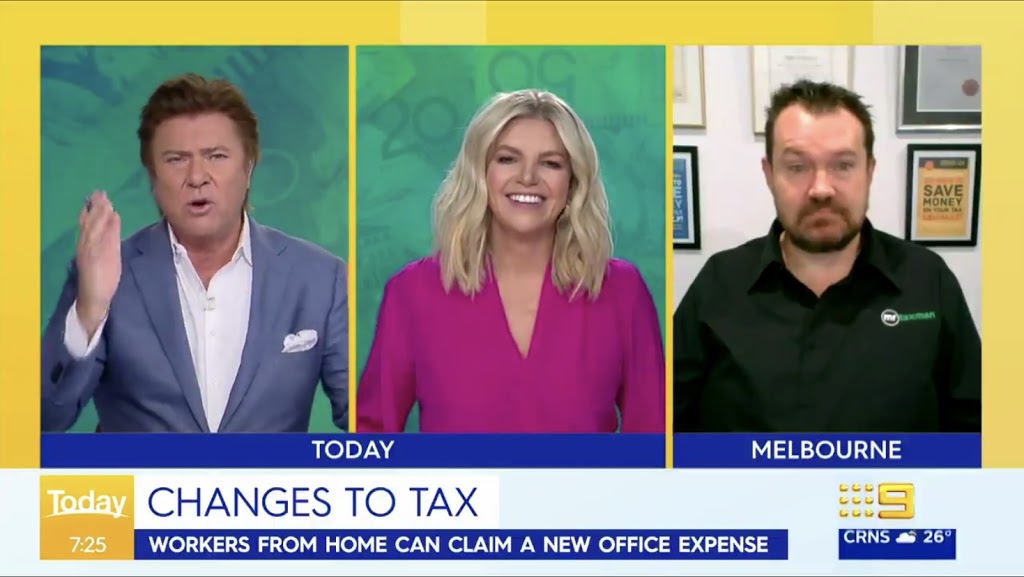

Need help with your tax? : Mr Taxman

Take the stress out of tax time with one of Australia's leading tax experts. Call Mr Taxman today on 1800 TAXMAN (1800 829 626) or drop an email to adrian@mrtaxman.com.au

Mr Taxman - Dr Adrian Raftery - 3 Bannie Ln, Mount Martha VIC 3934 ...

Mr Taxman - Dr Adrian Raftery is a business providing services in the field of Accounting, Finance, . The business is located in 3 Bannie Ln, Mount Martha VIC 3934, Australia. Their telephone number is +61 1800 829 626.

About Mr Taxman

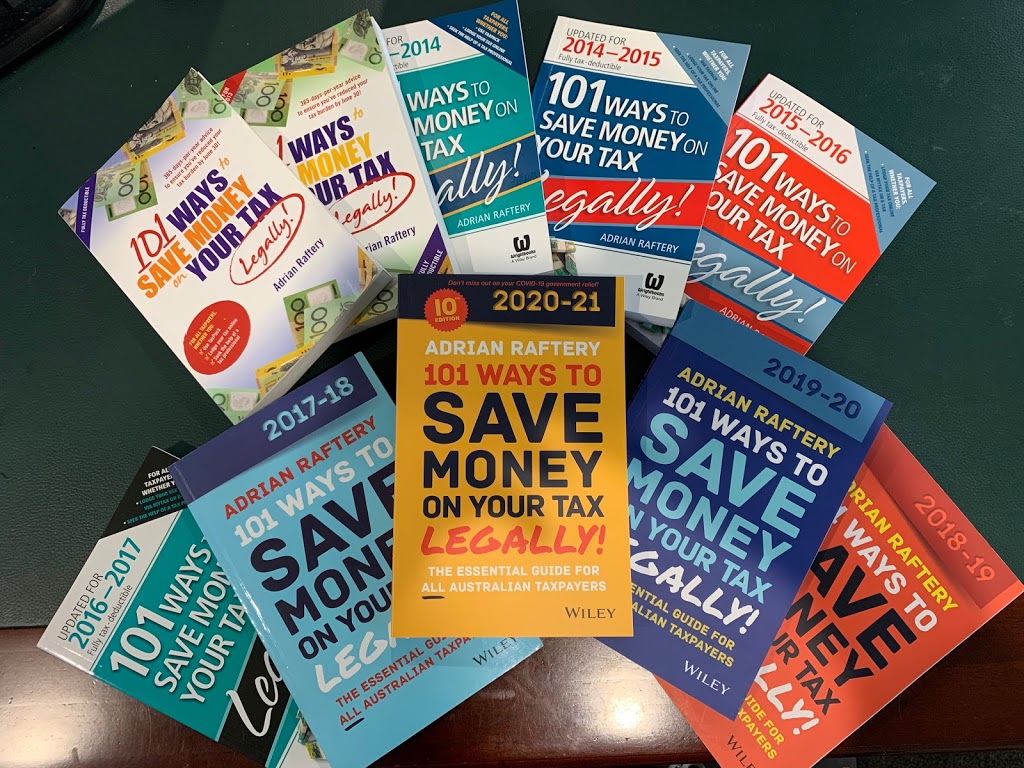

About Me Email: adrian@mrtaxman.com.au Mobile: 0418 210 599 Mr Taxman, aka Adrian Raftery, PHD, MBA, B.Bus, CPA, CTA, FCA, F Fin, FIPA FFA. Mr Taxman, Dr Adrian Raftery is the best-selling author of 101 Ways to Save Money on Your Tax - Legally! (now in its 10th edition) and is widely sought by the media for his views on tax, superannuation and financial issues.

Adrian Raftery - Bears of Hope

Chartered Accountant, Beard Grower, Bears of Hope Treasurer, Cricket Fan and part-time Leprechaun. Best known as Mr Taxman, Dr Adrian Raftery is the best-selling author of 101 Ways to Save Money on Your Tax - Legally! (now in its 10th edition) and is widely sought by the media for his views on tax, superannuation and financial issues.

Adrian Raftery | Contributor Profile | iSelect

Mr Taxman, Dr Adrian Raftery is the best-selling author of 101 Ways to Save Money on Your Tax - Legally! (now in its 11th edition) and is widely sought by the media for his views on tax, superannuation and financial issues. He runs a COVID-19 proof award-winning tax & accounting practice remotely in the Mornington Peninsula down in Melbourne.

Medicare Levy Surcharge (MLS) Information | iSelect

The Medicare Levy Surcharge is a tax you pay if you don't have private health cover and your annual taxable income is over $90,000 as a single or $180,000 as a couple or family. Depending on your income, the surcharge will be between 1% to 1.5%. It's designed to incentivise higher income earners to take up private health insurance, helping ...